Cross-practice team advises on the transformative deal which. Slack shares probably don't decline to the pre-deal price if the deal breaks. Latham & Watkins Advises Slack in its US27.7 billion Acquisition by Salesforce. The company would be able to cross sell its cloud-based products to Slack customers. Summary The Slack/Salesforce merger arbitrage is at an attractive spread. (WORK) CRM 34 Comments 13 Likes Ishan Puri 2.37K Follower s Summary Rumor is that Salesforce is looking to acquire. Slack had ended first-quarter fiscal 2022 with more than 169,000 paid customers. 30, 2020 3:06 PM ET Slack Technologies, Inc.

Thirdly, the buyout will bring a massive number of global customers to Salesforce.

#SLACK MERGER SOFTWARE#

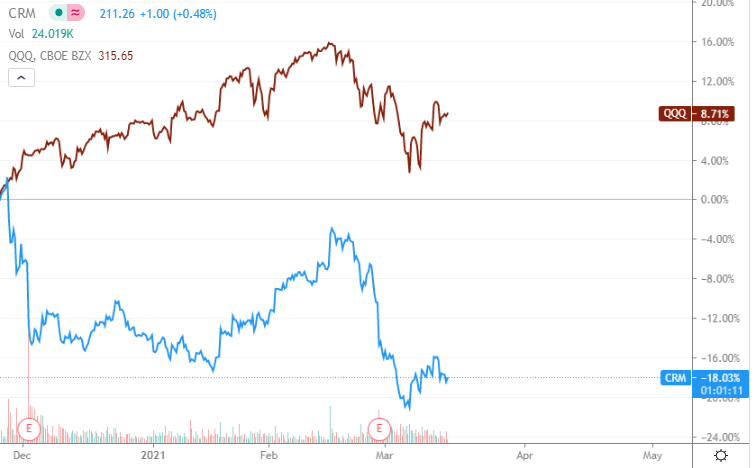

Per MarketsAndMarkets, the global digital transformation market size is estimated to reach $1.01 trillion by 2025 from $469.8 billion in 2020, reflecting a CAGR of 16.5% through 2020-2025. Jat 6:22 AM 2 min read Software giant Salesforce ( CRM) officially closed on its 27.7 billion record acquisition of messaging app Slack Technologies ( WORK) on Wednesday, as the. On January 1, 2021, Slack and Salesforce announced an. Secondly, the deal will help Salesforce capitalize on solid opportunities from the major digital transformation initiatives undertaken by organizations. This acquisition was to provide additional search offerings for employees within a Slack workspace. The company intends to integrate Slack’s software into its every cloud-based office suits, with the goal of improving collaboration between sales and customer support teams. Firstly, the buyout would enhance Salesforce’s team collaboration software capabilities. The acquisition of Slack is likely to be a huge win for Salesforce. CRM giant Salesforce has announced the completion of its acquisition of enterprise communications platform Slack, which it first announced in December of. Salesforce and Slack had announced their entry into a definitive agreement on Dec 1, 2020, under which the former agreed to acquire the latter in a cash and stock transaction worth 27.7 billion. Beyond the sticker shock of the 27 billion deal, two months after the shotgun adoption of Slack into the Salesforce family. Senior Salesforce staff were skeptical that they could increase sales by bundling and integrating Slack with its other products-a core rationale for the acquisition.Salesforce and Slack had announced their entry into a definitive agreement on Dec 1, 2020, under which the former agreed to acquire the latter in a cash and stock transaction worth $27.7 billion. In many ways, the Salesforce acquisition of Slack was surprising. Before the deal was even consummated, Benioff went out of his way to distance himself from Slack in public and private conversations, repeatedly telling colleagues and outside observers that Bret Taylor, who was then president and chief operating officer at Salesforce, was the deal’s architect. It has also destroyed more shareholder value in a week than any merger. It would be the 2nd largest software deal in history. Mutual distrust between Benioff and Slack CEO Stewart Butterfield became a distraction, according to more than a half-dozen current and former employees with direct knowledge of the situation. Salesforce’s bid to acquire Slack combines many points of interest.

We couldn’t be more excited to have Slack as part of the Salesforce family, combining the 1 CRM and the trailblazing digital platform for the work anywhere world, said Marc Benioff, Chair and CEO of Salesforce. Two years ago, Salesforce co-founder and CEO Marc Benioff gushed about his software company’s $28 billion purchase of messaging app Slack, describing it as a “match made in heaven.” It was also the most expensive subscription software acquisition of all time, with Salesforce paying around 26 times Slack’s forward revenue-a price tag that carried high expectations.īut problems emerged from the start. Salesforce (NYSE: CRM), the global leader in CRM, today announced it has completed its acquisition of Slack Technologies, Inc.

0 kommentar(er)

0 kommentar(er)